How Wisconsinites Can Make Sense Of The Health Insurance Marketplace

Most Wisconsinites will find several choices on the Health Insurance Marketplace during open enrollment for 2017.

The majority of counties across Wisconsin have three or more options in the Marketplace, also called the exchange, which was established by the Affordable Care Act. While some insurers have departed the state, others have joined, and Wisconsin remains one of the most competitive health insurance markets in the country. A map published by the Wisconsin Office of the Commissioner of Insurance shows the health insurance carriers available in each county and which plans are offered on the Marketplace.

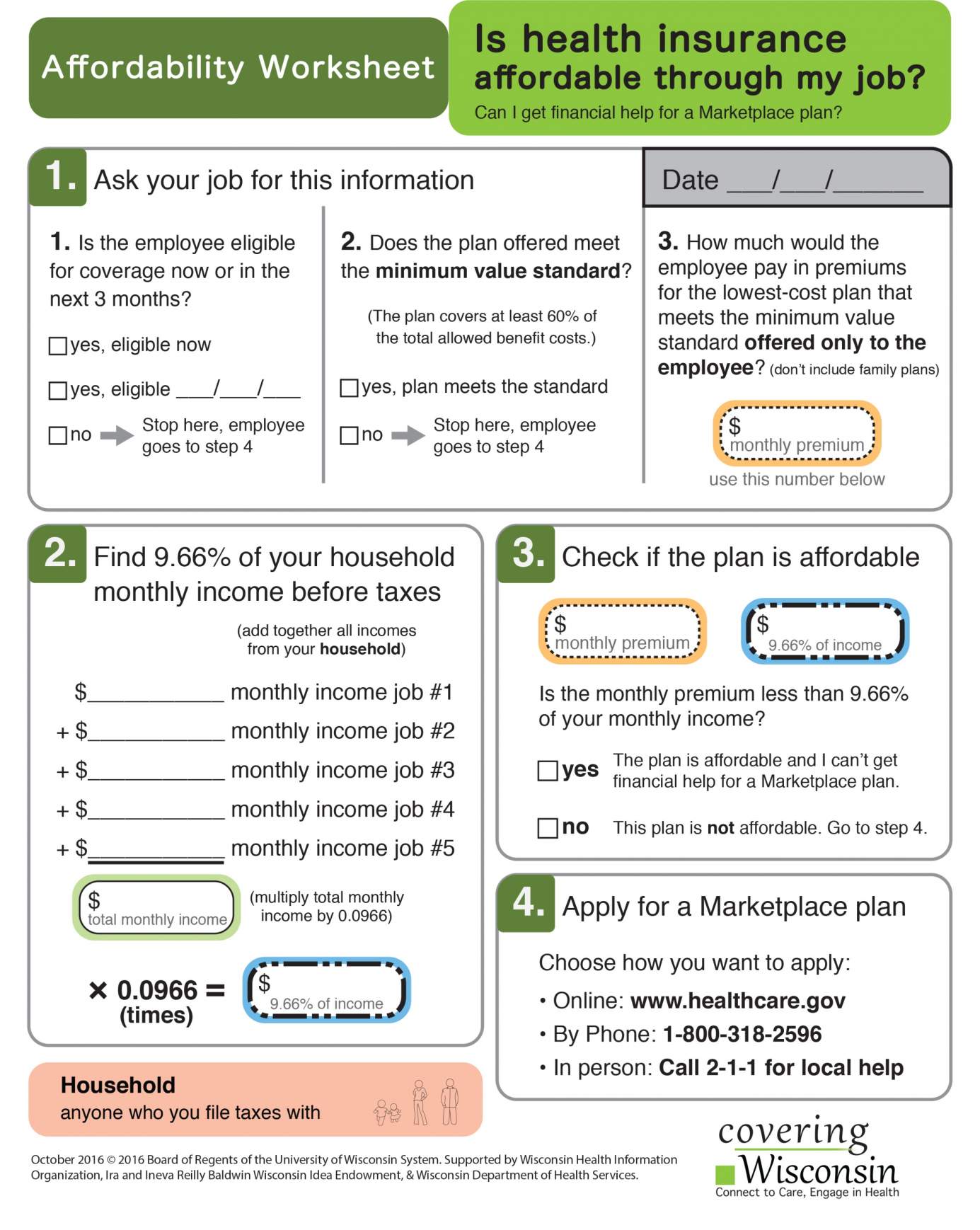

Anyone interested in looking for health insurance on the Marketplace should first find out if they can get coverage through their employer. If health insurance through their employer is considered "affordable," they can still sign up for a Marketplace plan but will not qualify for financial help (in the form of discounts or tax credits). The employee should ask about the cheapest employer health plan that covers just one person — if the monthly cost is less than 9.66 percent of their monthly household income before taxes, it is considered affordable. In this case, the employee won't be eligible for financial assistance for the Marketplace.

If the employer plan is not considered affordable, the employee should determine if they qualify for Medicare. To qualify, one must be 65 or older, or receive Social Security Disability Insurance, or have end-stage kidney disease.

The next option to consider is Wisconsin's Medicaid program, BadgerCare Plus, which is available for low-income adults and children. People can apply at any time to see if they qualify. Children and pregnant women qualify with higher incomes than other adults; therefore, it is possible for parents to have a Marketplace or an employer plan while the children have BadgerCare Plus. Covering Wisconsin or Wisconsin ACCESS can help people determine eligibility.

For people looking to get health insurance through the Marketplace, financial help may be available depending on their household income. For example, a household of three people with gross income of $6,670 or less a month would qualify for financial help. Additional financial help is available to more than half of the households in Wisconsin who buy "silver" level plans on the Marketplace, based on household income. Households that qualify for this cost-sharing reduction will have lower out-of-pockets costs for the health care they receive. HealthCare.gov offers a quick-check tool to help somebody find out whether their household qualifies for savings.

For 2017 coverage, the Health Insurance Marketplace will be open for enrollment from November 1, 2016 through January 31, 2017. By law, most people must have health insurance. Those without it may pay a fine in the form of a tax penalty, as much as $695 per adult (up to $2,085 per family) or 2.5 percent of income (up to $2,676 per person), whichever is greater.

Given the ongoing changes in Marketplace options, in-person enrollment assistance is more important than ever. Wisconsin residents can find free, local help with signing up for insurance by calling 2-1-1 or by going online to Covering Wisconsin's Get Covered Connector tool to locate their closest enrollment site and book a time to meet with a local enrollment assister.

Many health insurance companies have increased premiums for 2017 by an average of 16 percent in the Marketplace and private market. However, for households that qualify for financial help to help them pay for the cost of health insurance in the Marketplace, the amount of assistance is going up to cover the cost of the increased premiums. The calculation of eligibility of financial help for consumers, in the form of tax credits, is complicated and based on individual circumstances.

The level of potential financial help is based on the cost of the second cheapest "silver" level plan in the area, the number of people in the household and their age and geographical location, its income, and if anyone in it smokes. For example, for a 40 year-old single adult who lives in Dane County, does not smoke, and makes $29,000 a year, the cost of the monthly premium for the second cheapest "silver" level plan went up $26.53. However, the financial help for this person went up $27.78 in 2017. Therefore, the amount of assistance for 2017 should increase to compensate for the increase in premiums in many cases.

Wisconsinites should be aware that if they have plans that are no longer being offered on the Marketplace, they should choose a new plan between Nov. 1 and Dec. 15. If they do not choose a plan by the latter date, they will be auto-renewed in a similar plan from a different insurance company. This new plan could have different costs, health care network options, or covered prescriptions.

All Marketplace users will benefit by actively renewing their coverage — by reviewing their 2017 application information on their HealthCare.gov accounts. Even if they plan to keep their current coverage, they may qualify for more financial assistance, and they can review new options for the next enrollment year.

Additionally, some Wisconsin counties offer programs to help individuals and families with lower incomes pay their premiums. Staff at a local health department or an enrollment assister who helps people sign up for coverage can share information about these programs.

Lastly, it is important to choose a plan that meets health needs as well as the household budget. For someone who anticipates needing to use health insurance frequently during the year, a plan with a lower monthly premium may mean paying more each time health care services are used.

Getting answers to these questions can help people evaluate Marketplace plans and understand what they are choosing:

- How much is the monthly premium? When and how do I pay each month?

- How much will my prescriptions cost with this plan? Is my medication covered?

- Is the doctor I want to see covered? Is the doctor included in my network?

- How much will I pay to go see my doctor or a specialist? This is often a co-pay.

- How much will I pay to use the ER? This is either a co-pay or co-insurance.

- How much will I have to pay before the insurance company starts to pay a share? This is called a deductible.

- How much is the maximum amount I may pay for health care in a year? This is called the out-of-pocket max.

By asking the right questions, Wisconsinites can find the best plan for their health needs and their budget.

Jeni Appleby and Stephanie Severs are health insurance literacy specialists for Covering Wisconsin.